income tax rate philippines 2021

A corporation is resident if it is incorporated in the Philippines or if a foreign corporation ie incorporated. An income tax is a tax imposed on individuals or entities taxpayers in respect of the income or profits earned by them commonly called taxable incomeIncome tax generally is computed as the product of a tax rate times the taxable income.

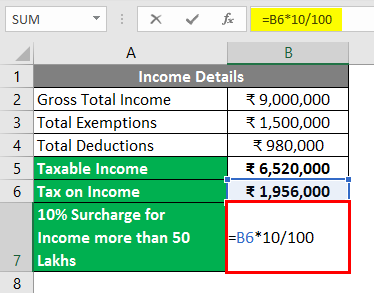

How To Calculate Income Tax In Excel

Interest on foreign loans.

. Income Tax Slabs 2021 Tax Rates for FY 2020-21 FY 2019-20 FY 2018-19. We welcome your comments about this publication and suggestions for future editions. Applicable tax rate depends on the realized profit of taxpayers and tax rate varies from 9 -15.

Income Tax in India. 12500 under Section 87A of IT Act. New Income Tax Portal Intro Key Features of the e-Filing Portal.

Youre required by law to file returns and pay taxes if you belong to any of these taxpayer categories. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. NW IR-6526 Washington DC 20224.

25 plus 15 tax on after-tax profits remitted to foreign head office. This maximum investment amount is decided by the government. On the profit up to EUR 100000 the tax rate shall be 9 fixed.

Income Tax Slab Rates for FY 2019-20 AY 2020-21. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. The most common sections in Income Tax Act are 80C 80CCD 1B 24 b and 80D.

Income Tax Slabs FY 2021-22 AY 2022-23 New Tax Rates for FY 2021-22 FY 2020-21 FY 2019-20. Morocco Last reviewed 02 September 2021 31. Personal Income Tax Rate in Philippines is expected to reach 3500 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations.

New tax regime-Section 115BAC. Calculate taxes- Income Tax Calculator FY 2020-2021 AY 2021-2022. Personal Income Tax Rate in Bangladesh averaged 2694 percent from 2004 until 2021 reaching an all time high of 30 percent in 2014 and a record low of 25 percent in 2005.

This page provides - United States Personal Income Tax Rate - actual values historical data forecast chart statistics. Myanmar Last reviewed 26 July 2022 22. Generally corporate income tax rate.

Branch tax rate. Tax rate Income tax in general 25 beginning 1 January 2021. Corporate income tax rate.

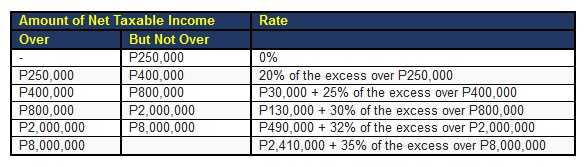

Progressive tax rate are as follows. Mozambique Last reviewed 25 June 2022 32. 1961 is available to the individuals who have a yearly income up to Rs.

Basics slabs and E-filing Process 2021. Based on the income tax slab an individual falls into they do their maximum tax saving. According to the budget released in 2019 there have been some changes in the structure of the tax slab in the interim budget 2019 the tax rebate of Rs.

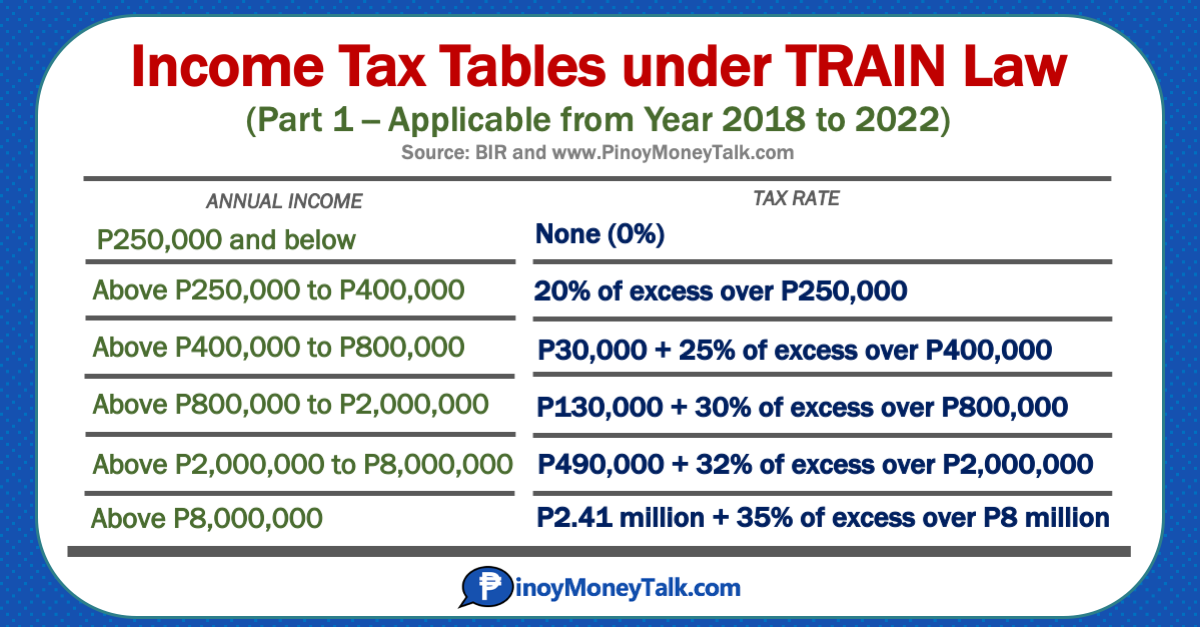

Employees with two or more employers whether at the same time or successively at any time within the. For FY 2021-22 and 2022-23 individual taxpayers will continue to choose between two tax regimes - the existing or old tax regime and. The Tax Caculator Philipines 2022 is using the latest BIR Income Tax Table as well as SSS PhilHealth and Pag-IBIG Monthy Contribution Tables for the computation.

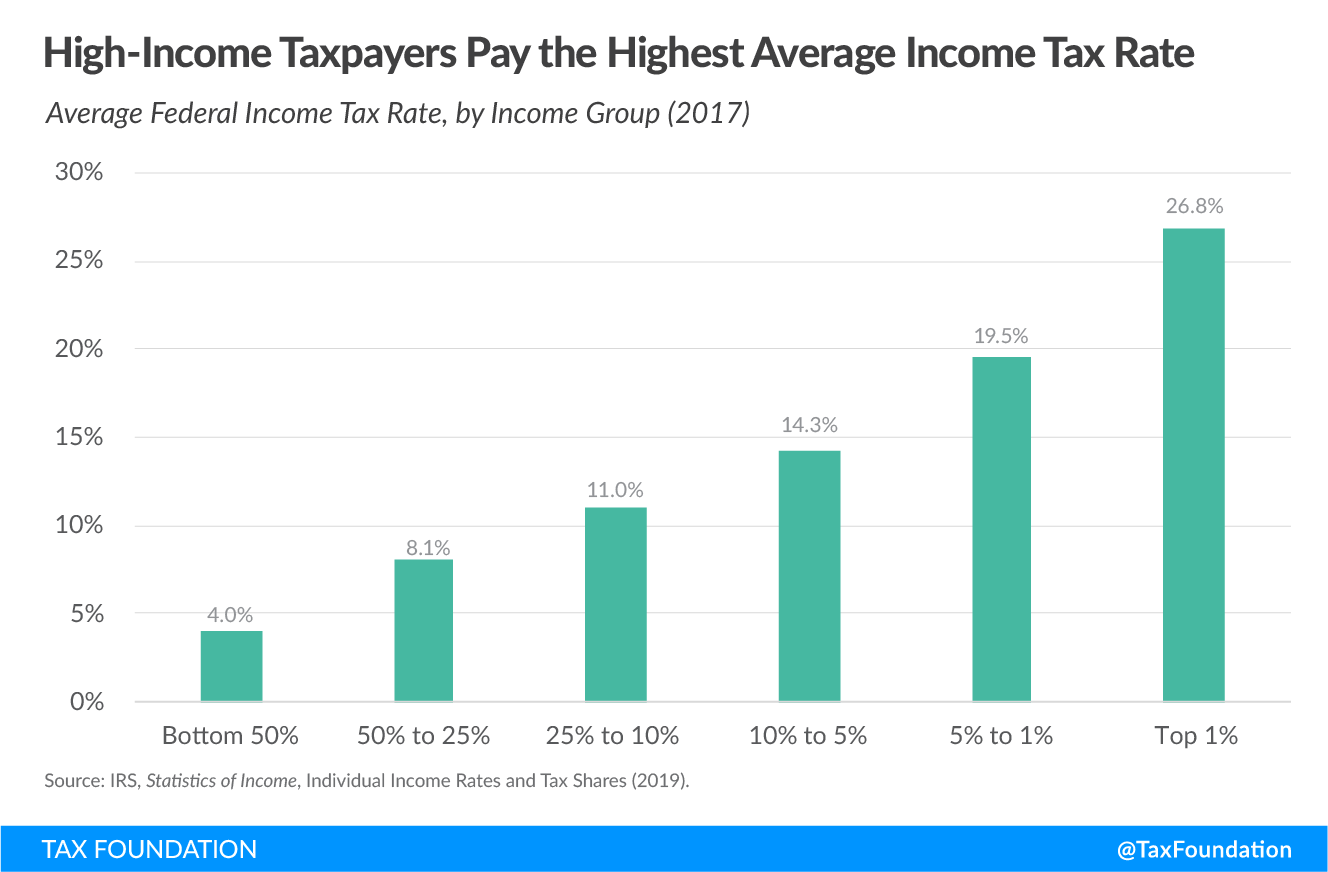

This page provides - Bangladesh Personal Income Tax Rate - actual values historical data forecast chart statistics economic. The income tax slabs and rates have been kept unchanged since financial year FY 2020-21. The Personal Income Tax Rate in the United States stands at 37 percent.

Income tax is levied on the income earned by all the individuals HUF partnership firms LLPs and Corporates as per. Filipinos living in the Philippines and earning income from sources within andor outside the country including the following. Capital gains tax rate.

At the end of the year Zhang should receive two income tax documents 1042-S with the income covered by a tax treaty and form W-2 if he has income about what is covered by the tax treaty. How to use BIR Tax Calculator 2022. The Personal Income Tax Rate in Bangladesh stands at 25 percent.

There were no changes announced in the income tax slabs both for old and new tax regimes for FY 2022-23 in Union Budget 2022. Dividends from domestic corporations if the country in which the foreign corporation is domiciled does not impose income tax on such dividends or allows a tax deemed paid credit of 15 or the difference ie 10. This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income.

In the long-term the Philippines Personal Income Tax Rate is projected to trend around 3500 percent in 2022 according to our econometric models. However every section amongst these has a pre-set maximum investment amount. Read the key highlights of Union Budget 2022 presented by FM Nirmala Sitharaman.

July 31 2022 084434 AM. Personal Income Tax Rate in the United States averaged 3671 percent from 2004 until 2020 reaching an all time high of 3960 percent in 2013 and a record low of 35 percent in 2005. Income covered by the tax treaty is taxed at 0 and all other income is taxed at the graduate rate for federal tax purposes.

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Income Tax In Excel

Corporate Income Tax Definition Taxedu Tax Foundation

Graduated Income Tax Or 8 Special Tax Which Is Better Accountableph

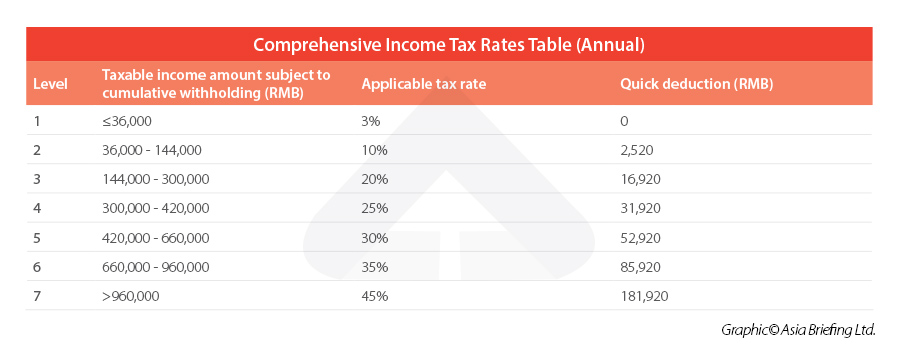

China Annual One Off Bonus What Is The Income Tax Policy Change

How To Compute The Income Tax Due Under The Train Law Cpa Davao Accounting Tax Business

Progressive Tax Definition Taxedu Tax Foundation

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Income Tax Formula Excel University

How To Calculate Foreigner S Income Tax In China China Admissions

Graduated Income Tax Or 8 Special Tax Which Is Better Accountableph

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Corporate Income Tax Definition Taxedu Tax Foundation

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Progressive Tax Definition Taxedu Tax Foundation

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Provision For Income Tax Definition Formula Calculation Examples

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)